What is a Currency Converter and How Does it Work?

Are you new to the world of currency? Have you been somewhat mystified about the pricing differences bevtween currencies and how they change over time? Do you ever notice a difference between various currency calculators across the web and wonder how they work?

Here’s the basics: A currency converter is basically a program designed to convert the value of one currency into another based on the market rate for that currency. The trick is where those values are generated. The values are usually based on the current market values or bank exchange rates, and this can make all the difference. We’ll show you what is a currency converter and why different companies state different exchange rates.

What is a Currency Converter and What are Exchange Rates?

Very simply, a currency converter uses exchange rates to show users how the values of two currencies are related. The exchange rate is the cost of money from one currency to another. How much does it cost to buy $1 US Dollar in Iraqi Dinars or how many Vietnamese Dong can you buy with 1 Iraqi Dinar?

Currency rates fluctuate with the market like other assets such as precious metals and stocks. Often the market price of a currency will vary from the rate you will receive at your bank. Currencies are always valued relative to another currency, and exchange rates are always based on how much someone else is willing to pay for your currency.

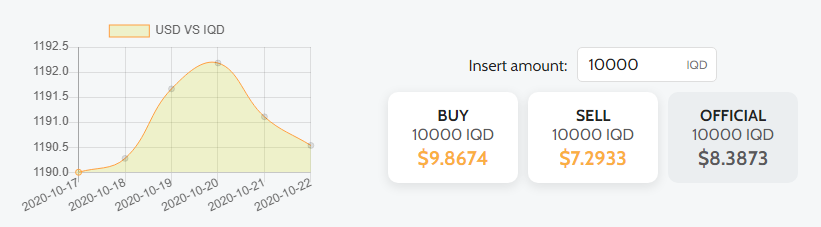

For example, let’s say you want to find the value of a currency relative to the US dollar. The US dollar is the base, and the currency you select will be valued against the dollar. When you enter 10,000 Iraqi Dinar into a converter, the software may tell you that it is worth 8+ US dollars. A good converter will also give you a trend chart and show you how that value has fluctuated over a period of time.

You can use the above currency converter at this link to see exchange rates for many currencies. The currency converter shown above provides 3 important pieces of information:

- Historical data in a chart

- Official market rate based on prices from FOREX markets

- The currency exchanger’s buy and sell rates

Converters will display the information as IQD/USD, IQD vs. USD, or vice versa. Note that the graph in the currency converter example above shows how many IQD you’ll get for 1 USD. The currency in the second position will always be the base currency. If the display was flipped, USD/IQD, you would see how the US Dollar is valued in Dinars. Another way to remember this is that the first currency listed is always equal to 1 unit. The second currency is how much of that second currency will it take to buy one unit of the first.

You may discover that month’s ago, 10,0000 Dinar was only worth $7. This indicates that the value of the Dinar is increasing in value relative to the Dollar. You could make several assumptions, either the Dinar was getting stronger in value or possibly the US dollar was getting weaker. Either way, if you are working in US Dollars, your holdings of Dinar has increased in value if you chose to exchange them.

To get a full picture of the strength of a currency such as the Iraqi Dinar, you can compare its exchange rate to other strong international currencies such as the Euro or British Pound. Doing so can help you determine the overall strength of a currency, and can help in making decisions on which currencies to collect and invest.

The best currency converters strive to use real-time data based on current markets. Because of the speed of information, this is easier today than decades ago. When looking at currency converters, it is important to find the exchanges where they gather their data. Also, it is important to look at the frequency the currency converter updates their exchange rate. Some converters will only update daily while others update hourly, even though they both claim real-time information.

Ready to buy?

Are you ready to buy your currency? Stop waiting and request a Shipping Kit. We will provide everything you need to ship and receive funds for currencies you own.

How to Calculate Exchange Rates

If you are wondering, why a currency converter is helpful, let’s walk through how to do the math on currency conversion. You can do this yourself without the help of a currency converter, but it takes some basic math you learned in school that many of us have probably forgotten.

Suppose that the GBP/USD exchange rate is 1.50 and you'd like to convert $100 U.S. dollars into British Pounds. To calculate this, follow one of these steps:

- Simply divide the $100 by 1.50 and the result is the number of pounds that will be received: 66.66 in that case.

- Converting pounds to U.S. dollars involves reversing the process by multiplying the number of Pounds by 1.50 to get the number of U.S. dollars.

Here’s an easy way to remember currency conversion math. Multiply across left to right and divide across right to left. The currency at the end of the direction is the desired output of the calculation.

If you’re planning to travel and you only need to convert a small amount of money, you are probably only interested in a relatively low degree of accuracy such as cents. Currency traders on the other hand pay attention to each decimal point in the transaction. A small fluctuation in currency can have a massive impact when leveraged for $1,000 of dollars for every $1 committed in a trade. If you begin trading and collecting currencies, you can easily see how you can quickly compare currencies as you make decisions on whether to buy or sell a currency.

The Hidden Costs of Conversion Spreads

There’s one more reason currency converters can be helpful. They help you identify conversion spreads, and these can be important to your pocketbook. The difference between the currency market and what your bank delivers is called a conversion spread. Banks and payment providers will add a markup on the price so they make a profit on the transaction.

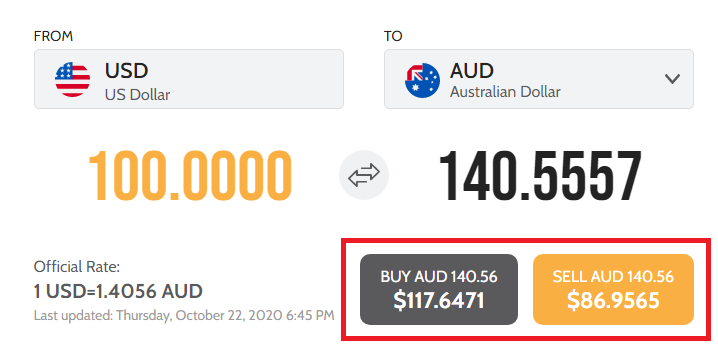

If the EUR/USD price is 1.20, the market is saying it costs 1 US dollar to buy 1 Euro. At the bank though, it may cost 1.27 dollars. The difference between the market exchange rate and the exchange rate they charge is their profit. To calculate the percentage discrepancy, take the difference between the two exchange rates, and divide it by the market exchange rate: 1.27 - 1.20 = 0.07/1.20 = 0.058. Multiply by 100 to get the percentage markup: 0.05 x 100 = 5.8%. The markup will be present regardless which direction of conversion you make. Whenever you trade or exchange currency, keep a sharp eye on the markup. Now you know the math, and can determine the markup percentage. The currency converter below shows a good example.

Here, the market spread is outlined in the red box. When comparing currency exchangers, make sure to look at spreads and other services like fully insured home delivery or e-check payments for your order.

At US First Exchange, we deal in a range of currencies, including exotic currencies like Iraqi Dinar and Vietnamese Dong. You can order foreign currency online and have your money shipped straight to your door in 24-48 hours. All shipments are fully insured, and we pride ourselves on having the industry’s lowest spreads.

Try our currency converter or sign up for our exchange rate alerts to keep track of your favorite currencies.

Ready to sell?

Are you ready to sell your currency? Stop waiting and request a Shipping Kit. We will provide everything you need to ship and receive funds for currencies you own.