Where to Exchange Currency Without Paying Huge Fees

As a traveler, investor, or collector, you’ll need to exchange currency, but the value of your money gets diminished due to exchange transaction fees. You probably guessed that airport kiosks and banks were going to hit you with bigger fees, but there are other hidden fees you may not realize. In this article, we will explain the basics of currency fees along with the various currency outlets and what they charge.

The Basics of Currency Exchange Fees

The basic fees for currency exchanges are commonly called conversion spreads. This is the difference between the currency market exchange rate and what your bank delivers at its exchange rate. Banks and payment providers will add a markup on the price so they make a profit on the transaction.

In other words, the price you see from a bank when exchanging currency includes their fee, and you can determine the fee by comparing the bank’s price with the market price. The same idea applies to airport kiosks and online currency exchange services.

Here’s a good example of how this can work using the Iraqi Dinar:

Suppose the USD/IQD price is 1,192.74, the market is saying it costs 1 US dollar to buy 1,192.74 Iraqi Dinars. At the bank though, it may cost $1.20. The difference between the market exchange rate and the exchange rate they charge is their profit. To calculate the percentage discrepancy, take the difference between the two exchange rates, and divide it by the market exchange rate: 1.20 - 1.00 = 0.20/1.00 = 0.20. Multiply by 100 to get the percentage markup: 0.20 x 100 = 20%.

Knowing the exchange rate gives you a baseline for what you should be paying. Recent, the popular airport exchange kiosk, Travelex, was advertising sale rates on Euros and British pounds. When compared to currency calculators, they were about 9% higher. This is a typical exchange fee you would expect to pay from a retail currency exchange company.

The markup will be present regardless which type of conversion you make (buy or sell). This is one of the benefits of using an online currency exchange. You’ll be able to see clearly what the currency exchanger is charging; the best online currency exchange services will clearly show their buy and sell prices alongside the market exchange rate. Try our currency converter or sign up for our exchange rate alerts to keep track of your favorite currencies.

Where to Exchange Currency with Low Fees

One thing to remember when exchanging currency is that you need to understand the transaction in both directions. It is often easy in the US to exchange dollars for an international currency, but exchanging in the other direction can be difficult. This is especially important for travelers and investors. Without any buy-back arrangements, you can be stuck holding onto currency you no longer want or need. If you want to buy foreign currency or sell back your unused currency, here are some popular options:

Banks & Credit Unions

Banks and credit unions do offer currency exchange services to their customers. They usually only hold popular notes at branches, while exotic currencies need to be ordered from elsewhere. Fees will vary across many banks, but it doesn’t hurt to spot check the exchange rate and transaction fees. Make sure to alert your bank or credit card company that you will be traveling. If not, they may freeze your account because of fraud suspicion.

Typically, you have to order from your local branch and pick up your currency from that physical location. If you use this option, make sure you give yourself plenty of time. It can take up to a week for many banks to secure your order for pickup. Although the fees are high, the best part about using a bank is that you are guaranteed to receive authentic currency as banks verify all notes they buy and sell.

Foreign ATMs

If you are outside the US, this can be a handy way to get local currency in an emergency. Banks will typically charge you a $3-$5 fee for international withdrawals on top of whatever fee they charge for providing an exchange, but the exchange rates tend to be similar to what would be charged if you visit a bank in person.

Again, this is really only an option for Travelers. You won’t be able to use ATMs to exchange back into US dollars and you’ll be stuck with any bills you didn’t spend. To avoid the $3-$5 transaction fee, you can open a checking account with a global back such as Citibank. Capital One also currently does not charge an additional fee for out-of-network transactions.

ATMs in airports and other places are convenient for travelers, but they charge high fees.

Credit Cards

Many credit cards, especially the ones that offer travel rewards, will allow you to buy things from all over the world without paying any transaction or exchange fees. They are safe and protect from fraud. The downside is that you will not be able to hold any physical currency in the country. Credit card companies don’t have any mechanism to ship paper currency to you.

This is important to know when traveling, because cash is needed to pay for things in many situations. Also, if you are planning on collecting or investing, you won’t be able to hold any foreign currency, you can only make purchases overseas.

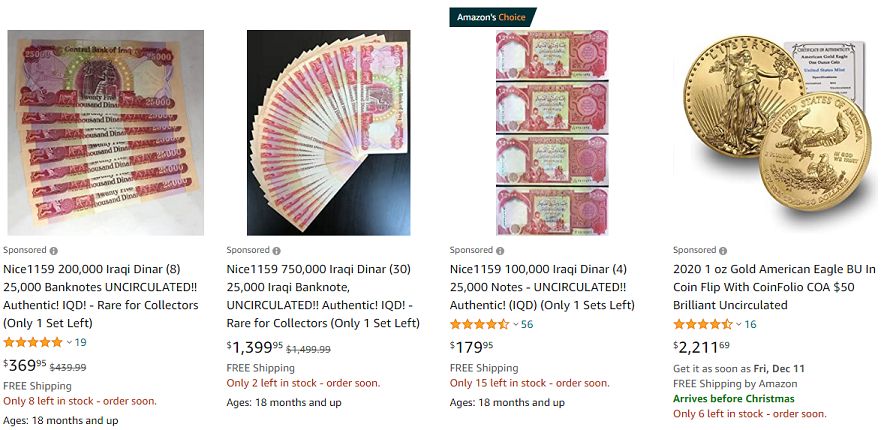

Ebay or Amazon

If you look at eCommerce retailers like Ebay or Amazon, you’ll see companies selling foreign currency, especially exotic currencies like Iraqi Dinar and Vietnam Dong. They will also ship foreign currency to you, but they will not insure the entire value of the package and they may take up to a week for delivery.

Fees are built into the price you pay for foreign currency when you use Amazon, Ebay, or another site.

Be careful with purchasing currency from these sites. Ebay and Amazon do not verify authenticity and are not responsible for any notes that are fraudulent. They also cannot guarantee the quality of the notes (circulated vs. uncirculated). This point is particularly important for exotic currencies, which are seen as being more valuable when they are uncirculated.

Street Vendors

In some large cities, there may be street vendors who will exchange currency. Although they may be convenient, the fees they charge vary widely, depending on location and competition. There is also the danger that the notes they sell are fraudulent; many street vendors do not verify authenticity using a currency detector.

Ready to sell?

Are you ready to sell your currency? Stop waiting and request a Shipping Kit. We will provide everything you need to ship and receive funds for currencies you own.

Airport Kiosks

We’ve referenced this option above as kiosks can be convenient for travelers. However, airport kiosks are notorious for charging high exchange fees. The one positive with kiosks is that you can exchange foreign currency back into US dollars at the airport, they will just take a larger fee on the transaction. By using Kiosks for buying and selling, you gain convenience, but you will lose money on both ends.

Many times you may not be able to find a kiosk that will exchange every currency. At this point, you need to use a currency broker or you can donate it at the airport. Several international airlines participate in UNICEF’s Change for Good program which takes donations in foreign currency. You can even mail unused foreign currency to this organization if you have already made it back home.

Online Currency Brokers

If you are looking for a one-stop shop that allows you to buy and sell foreign currency, there is no better place than online currency brokers. Exchange rates tend to follow the current market, and fees tend to be lower than companies that offer in-person currency exchange services and banks. Some brokers, like US First Exchange will deliver currency to your front door, and they will provide shipping kits to sell currency back for US dollars.

When using currency brokers, make sure they are secure sites and the company is registered with the Department of the Treasury. Some currency exchange sites are predatory, and they phish for your personal information.

In order to provide the most secure and safe transactions, US First Exchange is registered with the US Treasury as a Money Services Business (view a copy of our registration). We also provide a Certificate of Authenticity with each order containing a unique security hologram. In addition to federal regulation, we hold multiple state-specific licenses as a currency exchange. Where required, we are bonded as well.

The Bottom Line

When comparing currency exchangers, make sure to look at spreads and other services like fully insured home delivery or e-check payments for your order. If you’re looking for the best place where to exchange currency without high fees, look no further than US First Exchange.

At US First Exchange, we deal in a range of currencies, including exotic currencies like Iraqi Dinar and Vietnamese Dong. You can order foreign currency online and have your money shipped straight to your door in 24-48 hours. All shipments are fully insured, and we pride ourselves on having the industry’s lowest spreads.

Ready to buy?

Are you ready to buy your currency? Stop waiting and request a Shipping Kit. We will provide everything you need to ship and receive funds for currencies you own.