How Has the Value of Iraqi Dinar Changed Over Time?

The value of the Iraqi Dinar fluctuates over long time scales that are not seen for other mainstay currencies like dollars or euros. For this reason, some view exotic currencies like the Iraqi Dinar as a long-term investment. The rationale is: the Iraqi economy has remained bottomed-out since the US invaded in 2003, so it has nowhere to go but up. As a result, one would expect the value of the Iraqi Dinar to increase. Makes sense, right?

The reality is, like any investment, historical data is important to determine how that investment has performed over time. Therefore, we should use historical data on the value of the Iraqi Dinar, and even other exotic currencies, to determine how its value might change over time. Although things have gotten better in Iraq since 2003, unfortunately the Dinar is not immune to devaluation. Just this week, the Iraq Central Bank intentionally devalued the country’s currency by 22%, according to the Washington Post.

As our base comparison we will use the US Dollar (USD) to detail the value of the Iraqi Dinar (IQD). Let’s examine it overall multiple time frames. The purpose is to understand both short term performance of the currency as well as long term performance. Both are critical to understand how the Dinar’s value changes over time and what to expect if you plan to hold banknotes over long periods of time.

Value of the Iraqi Dinar

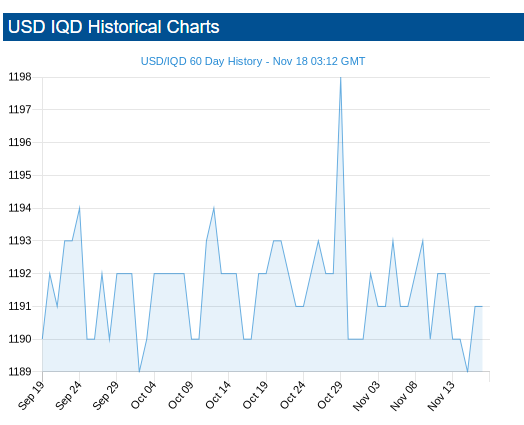

60 Day Performance (as of 11/18/2020)

Over the last 60 days, the USD:IQD exchange rate has hovered around 1192. There have been some fluctuations reaching the high of 1198 on Oct 29, 2020, and a low of 1189 around Oct 1, 2020. This means that, if you had purchased $1000 USD of Iraqi Dinar around Oct 1, 2020 at a rate of USD:IQD 1189, you would have gained $2.50 if you sold your Dinars at the recent rate of 1190.

What caused that jump in the Dinar’s value on Oct. 29, 2020? According a member of the Iraqi Parliamentary Finance committee, Naji Al-Saeedi, the Central Bank printed new currency on that date leading to the rise in the exchange rate. The rise was momentary, giving forex traders an opportunity to make some quick cash off a short-term investment.

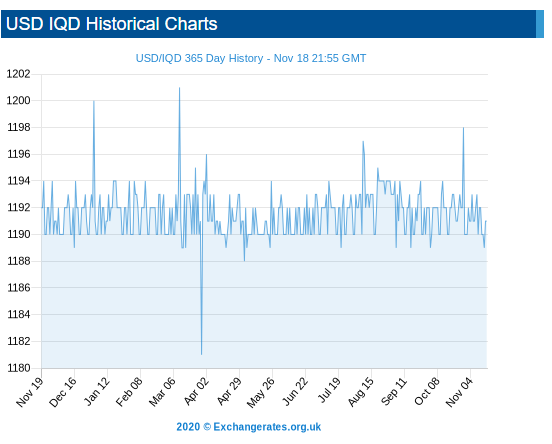

365 Day Performance

Over the last year, the Dinar has seen highs of 1201 USD:IQD and lows of 1182, but it has remained relatively stable around 1192. The spikes in value during the early spring of 2020 seem to be related to the beginning of the worldwide COVID pandemic and each country’s response to early outbreaks in their country. Even though there were wild swings during this short window, the currency seems to have stabilized again.

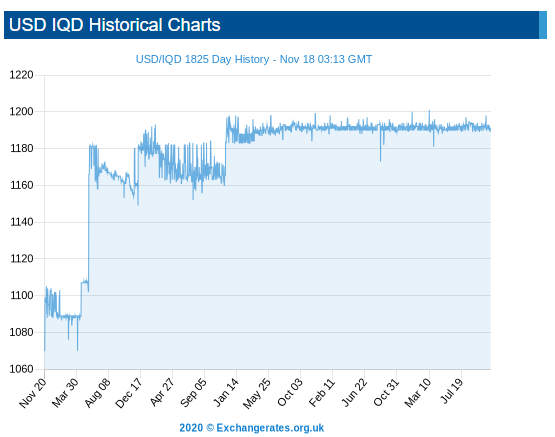

5 Year Performance

The 5 year performance of the Dinar shows a longer term view of the currency. The currency began its 5 year journey around 1090 and eventually reached today’s rate of 1192. This is significant growth as the country has continued to stabilize and control it’s monetary policies. In the graph below, note the sudden changes in the USD:IQD exchange rate

December 23, 2020 marked another record 1-day increase in the USD:IQD exchange rate from 1190 to 1459. Over the recent past, we have seen IQD weaken against USD, but a reversal is possible in the future as one can expect the economy to improve over the long term. This means that, right now, there has never been a better time to purchase Iraqi Dinar.

Key Takeaways

Investing in international currency is like any other investment. There are inherent risks that values will go down over time. When you look at the Dinar over a 5 year history, the swings in value are flattened out, and you see a steady improvement and stabilization of the currency.

At US First Exchange, we deal in popular and exotic currencies, including Iraqi Dinar and Vietnamese Dong. You can order foreign currency online and have your money shipped straight to your door in 24-48 hours. All shipments are fully insured, and we pride ourselves on having the industry’s lowest spreads. Sign up for our exchange rate alerts to track the value of Iraqi Dinar over time and find the best time to buy currencies.

In order to provide the most secure and safe transactions, US First Exchange is registered with the US Treasury as a Money Services Business (view a copy of our registration). In addition to federal regulation, we hold multiple state-specific licenses as a money services business. Where required, we are bonded as well.

Ready to sell?

Are you ready to sell your currency? Stop waiting and request a Shipping Kit. We will provide everything you need to ship and receive funds for currencies you own.